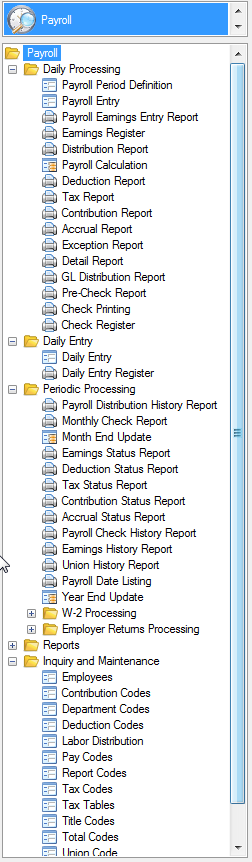

Payroll

Payroll Processing Module is a comprehensive payroll processing system for USA and Canadian payroll requirements. Whether running a single or a multi-site, multi-state operation with multiple user-defined deductions, the Payroll Module can meet your processing and reporting needs:

Supports an unlimited number of employees, user defined pay groups, pay types, deductions and benefits

Report payroll taxes for multiple federal tax IDs

Regular federal, state, and EIC tax table updates

Additional user defined tax tables to meet additional unique tax requirements

Multiple state/province capable

Generates Electronic or Printed W2 and W3 tax forms

Payroll review to edit and confirm payroll information prior to printing checks or posting payroll

Flexible direct deposit and electronic bank transactions allow multiple payment options and export file generation

Extensive built-in payroll reports help track wage, benefit and tax history

Supports customization to meet your unique payroll requirements